The following stockholders equity accounts arranged – The following stockholders’ equity accounts arranged provide a comprehensive overview of the various types of equity accounts that may be included on a company’s balance sheet. These accounts represent the ownership interest of the shareholders in the company and are essential for understanding the financial health of the organization.

This guide will discuss the purpose of arranging stockholders’ equity accounts, provide examples of typical accounts, and explain the different methods used to arrange them. Additionally, it will cover the accounting treatment for common stock, preferred stock, treasury stock, and retained earnings.

Finally, it will discuss the different ways to present stockholders’ equity on the balance sheet and the advantages and disadvantages of each format.

Stockholders’ Equity Accounts Arrangement: The Following Stockholders Equity Accounts Arranged

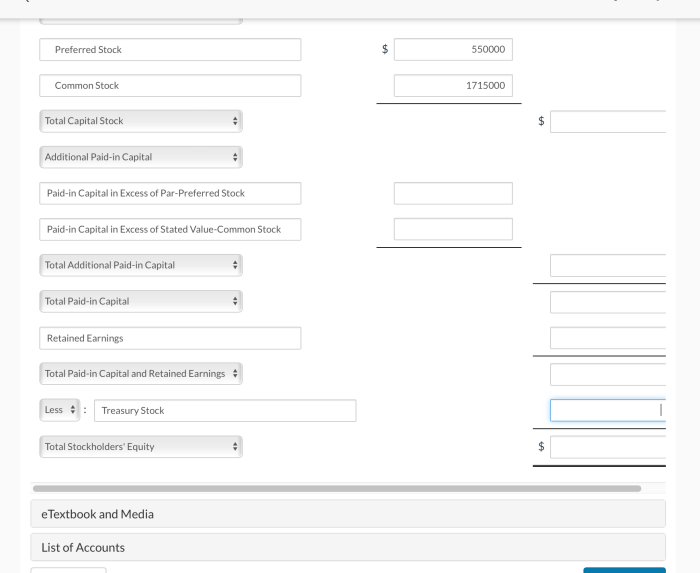

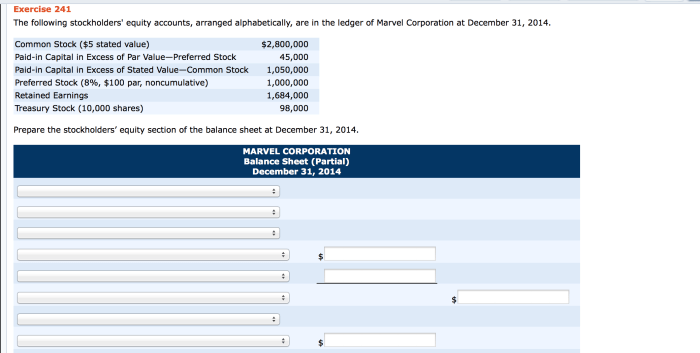

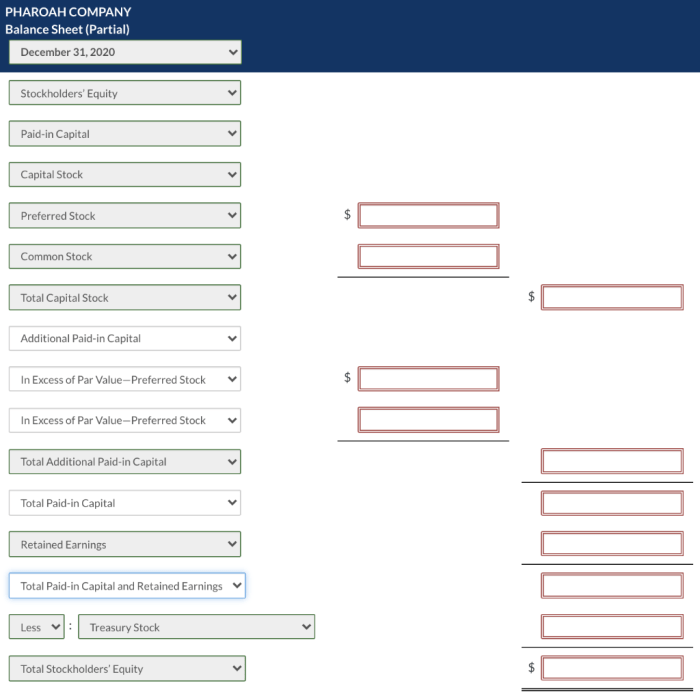

The purpose of arranging stockholders’ equity accounts is to provide information about the ownership interests in a company and the changes in those interests over time. Stockholders’ equity accounts include common stock, preferred stock, treasury stock, retained earnings, and other equity accounts.

The different methods used to arrange stockholders’ equity accounts include the single-step method and the multiple-step method. The single-step method presents all of the stockholders’ equity accounts in a single section of the balance sheet. The multiple-step method presents the stockholders’ equity accounts in two sections: the contributed capital section and the retained earnings section.

Common Stock, The following stockholders equity accounts arranged

Common stock is the most basic type of stock. It represents the ownership interest in a company. Common stockholders have the right to vote on company matters and to receive dividends. Common stock is typically accounted for at par value.

Preferred Stock

Preferred stock is a type of stock that has a preference over common stock in the payment of dividends and the distribution of assets in the event of liquidation. Preferred stockholders typically do not have the right to vote on company matters.

Treasury Stock

Treasury stock is a company’s own stock that it has repurchased. Treasury stock is not considered to be outstanding and is not entitled to dividends or voting rights.

Retained Earnings

Retained earnings are the cumulative net income of a company that has not been distributed to shareholders as dividends. Retained earnings are used to finance the company’s operations and growth.

Other Equity Accounts

Other equity accounts may include additional paid-in capital, accumulated other comprehensive income, and foreign currency translation adjustments.

Presentation of Stockholders’ Equity

Stockholders’ equity can be presented on the balance sheet in a variety of ways. The most common presentation formats are the single-step method and the multiple-step method.

The single-step method presents all of the stockholders’ equity accounts in a single section of the balance sheet. The multiple-step method presents the stockholders’ equity accounts in two sections: the contributed capital section and the retained earnings section.

Frequently Asked Questions

What is the purpose of arranging stockholders’ equity accounts?

The purpose of arranging stockholders’ equity accounts is to provide a clear and concise view of the ownership interest of the shareholders in the company. This information is essential for financial analysts, investors, and anyone interested in understanding the financial health of the organization.

What are the different methods used to arrange stockholders’ equity accounts?

There are two main methods used to arrange stockholders’ equity accounts: the single-step method and the multiple-step method. The single-step method combines all of the stockholders’ equity accounts into a single total. The multiple-step method presents the stockholders’ equity accounts in a more detailed format, showing the individual components of equity.

What are the advantages and disadvantages of each method of arranging stockholders’ equity accounts?

The single-step method is simpler and easier to understand, but it does not provide as much detail as the multiple-step method. The multiple-step method is more detailed and provides a clearer view of the individual components of equity, but it is more complex and difficult to understand.